9 Which of the Following Is True of Outstanding Shares

On January 1 2014 Vancleave Corporation had 110000 shares of its 001 par value common stock outstanding. Question added by Shahbaz Hayder Group Head of Finance Sharif Group.

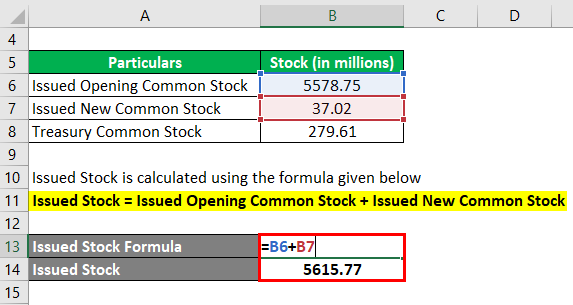

Shares Outstanding Formula Calculator Examples With Excel Template

Outstanding shares are the actual shares issued or sold.

. Which of the following is not true about stock splits. The Outstanding shares are less than or equal to Issued shares. B Failure to pay dividends will result in default.

MW had 7800 shares of outstanding stock. Then the value of the firm will be equal to the shares of outstanding stick multiplied by the value per share. B 10000 shares have been sold.

92-35 On June 1 Summit Corporation issued 1000. Examine the following cash flow statements and answer the question below. While outstanding shares are a determinant of a stocks liquidity the latter is largely dependent on its share float.

The number of outstanding shares is increased. Up to 256 cash back Issued 70000 shares of common stock at 18 receiving cash. B Most secondary market transactions directly affect the capital of the firm that issues the securities.

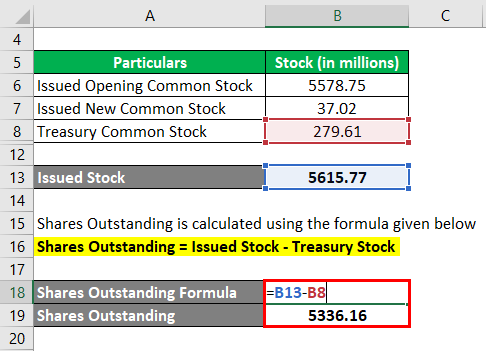

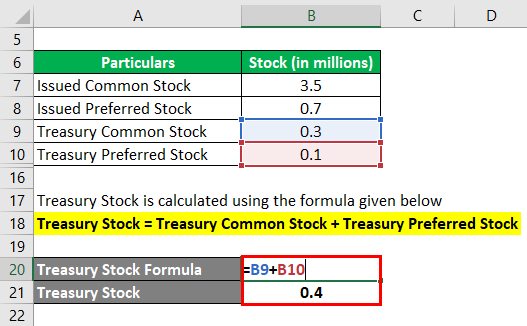

Proportional ownership is unchanged. Outstanding shares Formula. Authorized shares are the maximum number of shares a company is allowed to issue to investors as laid out in its articles of incorporation.

On November 27 when the market price of the stock was 8 the corporation declared a 10 stock dividend to be issued to stockholders of record on December 28 2014. C An active secondary market causes firms to sell their new debt or equity issues at a higher transaction cost of funds. The corporation could not sell its equity shares at an amount in excess of the amount of its authorized share capital.

All of the following statements are true concerning treasury stock except. Which of the following statements is true. In secondary markets outstanding shares of stock are bought and sold among investors.

A Preferred stock has a higher-priority claim on the firms assets than common stock. Outstanding shares Issued shares Treasury stock Example of Issued and Outstanding Share Let us consider an example to understand it better. Shares of stock authorized 8000 shares issued and 7000 shares outstanding.

Issued 23000 shares of preferred 2 stock at 120. A B C Cash From Operating 250 -300 -250 Cash From Investing -400 400 100 Cash From Financing 150 -100 150 Net Change in Cash 0 0 0 Is the following statement true or false. Sold 14000 shares of treasury common for 210000.

CPreferred shares are shares that have been retired. Capital dividends that have been declared using the ITA 832 election are not subject to the usual gross up and tax credit procedures. Is accounted for by the cost method.

ANo gain recognized. Has 50000 issued shares. In 2007 Bell declared and paid dividends of.

Is the following statement true or false. Suppose stock is currently at 3565. The equity shares available that can be purchased in the stock market are called a Treasury shares b Outstanding shares c Authorized shares d Issued shares Question 15.

When a corporation redeems all or part of its outstanding shares the difference between the proceeds of redemption and the PUC of the shares will be treated as a capital gain for tax purposes. Sold 21000 shares of treasury common for 420000. True False False.

Which of the following statements is TRUE. Firm A is the only firm that appears to be growing. BIt is very unlikely that corporations will have more than one class of shares outstanding.

True b False Question 14. These cannot be more than issued shares but can be equivalent to it if there is no treasury stock. AIf Nagins basis in the old asset was 95000 Nagin can recognize a 5000 loss.

A There are 1000 shares of treasury stock. Retained earnings are changed. Does not change the number of shares outstanding.

A company may have 100 million shares outstanding but if 95 million of these. Market price per share is reduced after the split. Does not change the number of shares issued.

When a certain number of outstanding shares are exchanged for one new share it is known as a. C Preferred stock has a lower-priority claim on the firms assets than the firms creditors in the event of default. A In secondary markets outstanding shares of stock are bought and sold among investors.

Which ONE of the following statements is true about secondary markets. C There are 7000 shares of treasury stock. Reduces stockholder claims on corporate assets.

From the information given in the question we have to calculate the value per share first. Purchased 42000 shares of treasury common for 714000. D The amount of treasury stock cannot be determined from the information given.

Compute MWs recognized gain on its exchange of stock for property and determine MWs tax basis in the property received from Mrs. Shares issued treasury shares restricted shares 25800 5500 2 x 2000 16300. Montrose Metal Products has 300000 common shares outstanding which were sold for an.

Outstanding stock of the Bell Corporation included 20000 shares of 5 par common stock and 10000 shares of 6 10 par noncumulative preferred stock. Therefore the market capitalization of the firm is 16300 x 3565 581095. D Preferred stock typically pays a.

The market expects this companys cash flows to grow significantly in the future. Project Finance Cash Flow Forecasting Financial Reporting Financial Systems Feasibility Studies. Assets 1500 Total debt 900 Liabilities 1150 Equity 350 Stock price 35 Shares outstanding 100 Cash Flow Statement.

If a shareholder reinvests dividends under a corporations dividend reinvestment plan the dividends are. DThe outstanding number of shares is the maximum number of shares that can be issued by a corporation. For an investor the function of secondary markets is to provide profitability for the shares of securities they own.

Next Consider the following two balance sheets for firms A and B and answer the question below. AThe shares that are in the hands of the shareholders are said to be outstanding. Company A has a net income of 12500 as per the latest financials.

Shares Outstanding Formula Calculator Examples With Excel Template

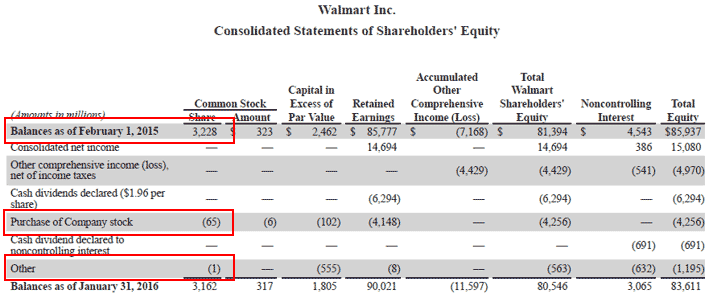

Issued Vs Outstanding Shares Top 6 Differences Infographics

Shares Outstanding Formula Calculator Examples With Excel Template

.jpg)

Shares Outstanding Meaning Formula Investinganswers

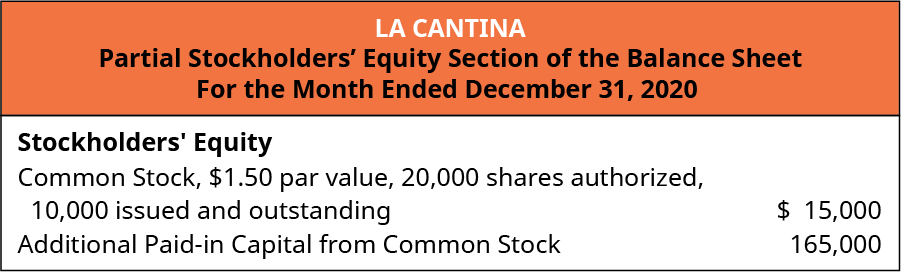

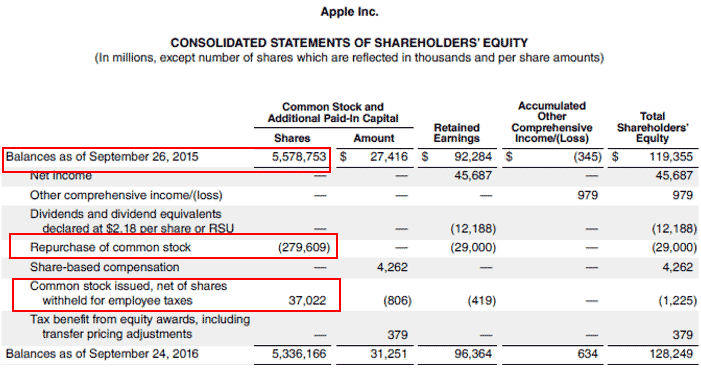

Analyze And Record Transactions For The Issuance And Repurchase Of Stock Principles Of Accounting Volume 1 Financial Accounting

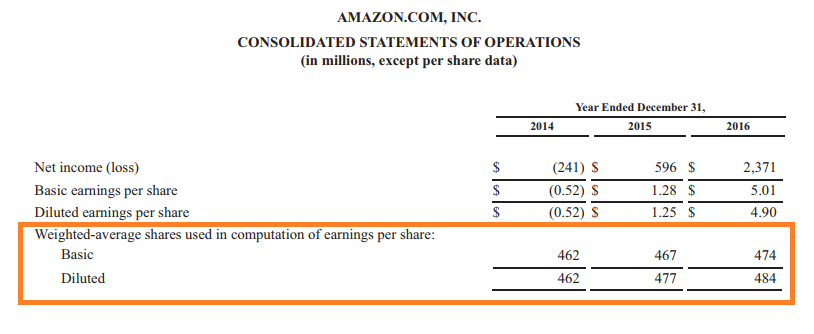

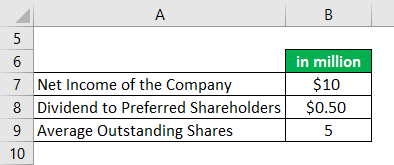

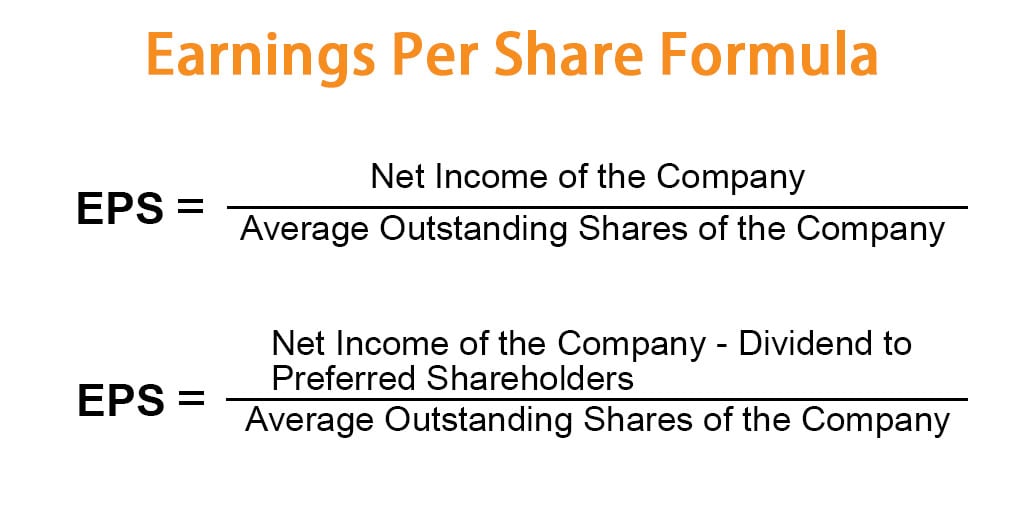

Earnings Per Share Formula Eps Calculator With Examples

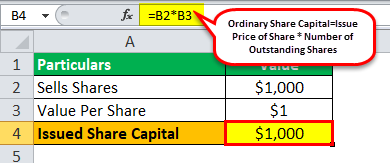

Ordinary Shares Capital Definition Formula Calculations With Examples

Shares Outstanding Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

Weighted Average Of Outstanding Shares Definition

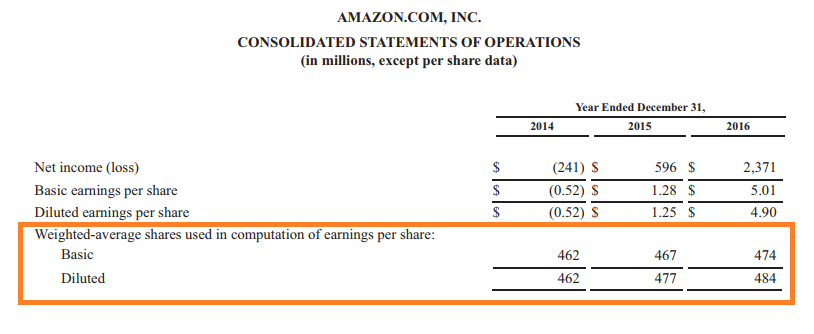

Weighted Average Shares Outstanding Example How To Calculate

Earnings Per Share Formula Eps Calculator With Examples

/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

Weighted Average Of Outstanding Shares Definition

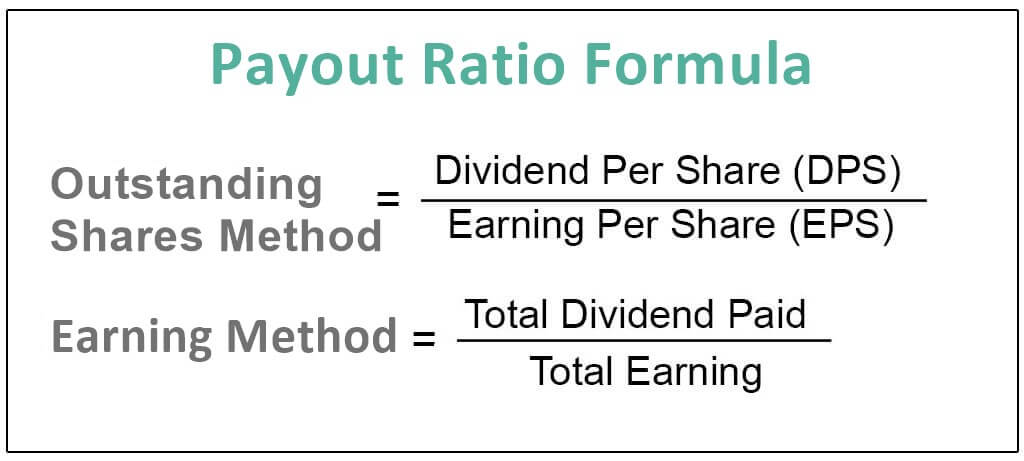

Payout Ratio Formula How To Calculate Dividend Payout Ratio

Issued Vs Outstanding Shares Top 6 Differences Infographics

Shares Outstanding Formula Calculator Examples With Excel Template

Which Of The Following Represents The Largest Number Of Common Shares In 2022 Cost Of Goods Sold Representation Largest Number

/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

Weighted Average Of Outstanding Shares Definition

Shares Outstanding Formula Calculator Examples With Excel Template

Comments

Post a Comment